|

Saving for retirement is complicated, so it's not surprising that a few fundamental guidelines have become popular over the years to help simplify complex ideas. Here are four that you might have come across in reading, researching, or just talking with friends. Like most guidelines, they offer helpful starting points but need to be examined critically and adjusted for your specific situation. Save 10% of your pay for retirement. This is a good beginning, but many retirement experts suggest saving 15% of your salary. If you started late, you may need to save more. At the very least, save enough to receive any matching funds offered by your employer. Consider this: If you save just 6% of your salary and your employer offers a full 6% match, you are already saving 12%! The percentage of stock in your portfolio should equal 100 minus your age.

This reflects a fundamental idea that younger people can take on more investment risk for potential gain, while older people approaching retirement should protect their principal by converting some volatile growth-oriented stock investments to more stable fixed-income securities. Although the strategy is sound, the math may no longer be appropriate considering long life spans and low yields on fixed-income investments. For example, if you followed this rule at age 40, 60% (100 minus 40) of your portfolio would consist of stock, and at age 60, the percentage of stock would be 40%. Depending upon your situation and risk tolerance, you may require a higher percentage of stock at either of these ages to meet your retirement savings goals. You need 70% of your pre-retirement income during retirement. This is an older guideline — 80% is now more commonly suggested. But, in fact, there is no magic number, and you may be better off focusing on your actual expenses today and thinking about whether they'll stay the same, increase, decrease, or even disappear by the time you retire. While some expenses might disappear, like a mortgage or costs for transportation to and from work, new expenses may arise, such as travel, help with home maintenance, and increased medical costs. A typical 65-year-old couple who retired in 2017 might spend $275,000 on medical care in retirement, even with Medicare.1 Calculate how much you may need to pay your retirement expenses and add a cushion for unexpected events. A "safe" withdrawal rate is 4%. The "4% rule" suggests that you make annual withdrawals from your retirement savings equal to 4% of the total when you retire, with annual adjustments for inflation. This model was developed in the 1990s for a 30-year retirement with a portfolio that included 50% large-cap stocks.2 Although this may be a helpful guideline, some experts suggest a lower rate, and there are many other withdrawal models. Factors to consider include the value of your savings, the amount of income you anticipate needing, your life expectancy, the rate of return you expect from your investments, inflation, taxes, and whether you're single or married. Asset allocation is a method used to help manage investment risk; it does not guarantee a profit or protect against investment loss. The return and principal value of stocks fluctuate with changes in market conditions. Shares, when sold, may be worth more or less than their original cost. 1) CNBC, October 5, 2017 2) The Balance, August 18, 2017 This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2018 Broadridge Investor Communication Solutions, Inc.

3 Comments

The Tax Cuts and Jobs Act has made the tax code more favorable for small businesses. Still, owners will want to take full advantage of every legal tax break they can find. The following deductible business costs could help reduce your 2018 tax bill. Be sure to consult with your tax professional before you take any specific action. Home Office Deduction

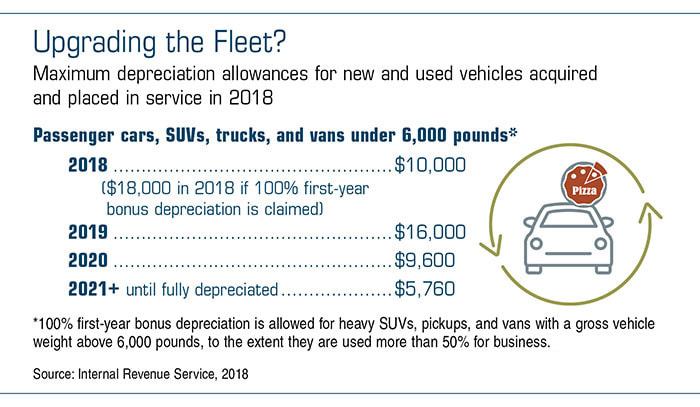

Business owners who operate out of a qualifying home office have two available claiming options, either of which could result in a larger deduction. Whichever option the taxpayer chooses, the eligibility criteria are the same. To qualify for a deduction, a home office must be used in a trade or business — not to manage personal investments or pursue a hobby. It must also be used regularly and exclusively for business. Under the original method, eligible taxpayers can write off a percentage of home expenses such as depreciation, rent, property taxes, insurance, utilities, maintenance, and repairs. The percentage is based on the square footage of the office space relative to the total size of the home. A newer, simplified option allows taxpayers to claim a flat $5 per square foot of the office, up to 300 square feet. Thus, the deductible amount is capped at $1,500. This simple formula doesn’t take home expenses into account, so it’s easier to figure out and generally lightens the record keeping burden. However, business owners with relatively high home expenses may be able to claim more than $1,500 for a home office if they use the more complex calculation method. Autos for Business Use If your business relies on the use of one or more vehicles, it pays to consider the potential tax implications, such as whether to take the mileage deduction, lease versus buy, and depreciation. Small businesses can take a deduction for auto expenses based on the number of miles traveled using the standard mileage rate (54.5¢ per business mile for 2018) plus parking and tolls. An alternative method involves adding up the actual costs, including lease payments or vehicle depreciation, car maintenance, and gas, for vehicles used at least 50% for business purposes. In 2018, the first-year depreciation deduction for “luxury” vehicles has become significantly more generous thanks to the Tax Cuts and Jobs Act. The IRS generally expects taxpayers who claim vehicle deductions to keep a log that tracks the date, destination, purpose, and odometer readings for each business trip. This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2018 Broadridge Investor Communication Solutions, Inc. Federal Reserve monetary policies can affect the financial markets, and the prospect of higher inflation and interest rates has become a major concern for bond investors. Even so, many investors rely on bonds to temper the effects of stock market volatility on their portfolios or to generate income in retirement.

Here are some strategies that may help your fixed-income portfolio weather a period of interest rate uncertainty. Keep It Short and Hold On When interest rates rise, the value of existing bonds typically falls, because new bonds with higher yields are more attractive. Investors are also less willing to tie up their funds for a long time, so bonds with longer maturity dates are generally more sensitive to rate changes than shorter-dated bonds. Thus, one way to help address interest rate risk is to focus on short- and medium-term bonds, even though they will generally offer lower yields. When a bond is held to maturity, the bond owner receives the face value and interest, unless the issuer defaults. However, bonds redeemed prior to maturity may be worth more or less than their original value. Thus, rising interest rates should not affect the return on a bond you hold to maturity but may affect the price of a bond you want to sell on the secondary market. Consider Duration Duration is a more specific measure of interest rate sensitivity. A bond’s duration is derived from a complex calculation that includes the maturity date, the present value of principal and interest to be received in the future, and other factors. If there are two bonds with a particular maturity, the bond with the higher yield will typically have a shorter duration. For example, U.S. Treasuries generally have lower yields than similarly dated corporate bonds, which means Treasuries also have longer durations and tend to be more rate sensitive. What About Funds? Bond funds — mutual funds and exchange-traded funds (ETFs) composed mostly of bonds and other debt instruments — are subject to the same inflation, interest rate, and credit risks associated with their underlying bonds. Consequently, the share prices of funds that hold short- or medium-term bonds may be more stable than those holding longer-term bonds. Bond funds do not typically have set maturity dates, but you can look at the fund’s duration. Keep in mind that fund managers might respond differently if falling bond prices adversely affect a fund’s performance. Some might try to preserve the fund’s asset value by reducing its yield. Others might preserve a fund’s yield at the expense of its asset value by investing in riskier bonds of longer duration or lower credit quality. Information on a fund’s management, objectives, and flexibility in meeting those objectives is spelled out in the prospectus. Beyond interest rates, fund returns can be driven by a variety of dynamics in the market and the broader economy. In a rising rate environment, as underlying bonds mature and are replaced by higher-yielding bonds, the fund’s yield and/or share value could potentially increase over time. For investors with longer time horizons, reinvesting the interest paid by the fund could also help offset any losses in share value. The return and principal value of bond funds and ETFs fluctuate with market conditions. Shares, when sold, may be worth more or less than their original cost. Supply and demand for ETF shares may cause them to trade at a premium or a discount relative to the value of the underlying shares. Mutual funds and ETFs are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest. This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2018 Broadridge Investor Communication Solutions, Inc. |

Archives

January 2019

Categories

All

|

|

|

Contact Us

|

© 2024 Sunshine Financial Solutions of South Florida, Inc.

Securities offered through OneAmerica Securities, Inc., a Registered Investment Advisor, member FINRA SIPC. Sunshine Financial Solutions of South Florida, Inc. is not an affiliate of OneAmerica Securities or the companies of OneAmerica and is not a broker dealer or Registered Investment Advisor. Provided content is for overview and informational purposes only and is not intended and should not be relied upon as individual tax, legal, fiduciary, or investment advice. Neither OneAmerica Securities, the companies of OneAmerica, or Sunshine Financial Solutions of South Florida, Inc. provide tax or legal advice. For answers to specific questions and before making any decisions, please consult a qualified attorney or tax advisor. Guarantees are subject to the claims paying ability of the issuing insurance company.

Securities offered through OneAmerica Securities, Inc., a Registered Investment Advisor, member FINRA SIPC. Sunshine Financial Solutions of South Florida, Inc. is not an affiliate of OneAmerica Securities or the companies of OneAmerica and is not a broker dealer or Registered Investment Advisor. Provided content is for overview and informational purposes only and is not intended and should not be relied upon as individual tax, legal, fiduciary, or investment advice. Neither OneAmerica Securities, the companies of OneAmerica, or Sunshine Financial Solutions of South Florida, Inc. provide tax or legal advice. For answers to specific questions and before making any decisions, please consult a qualified attorney or tax advisor. Guarantees are subject to the claims paying ability of the issuing insurance company.

RSS Feed

RSS Feed