|

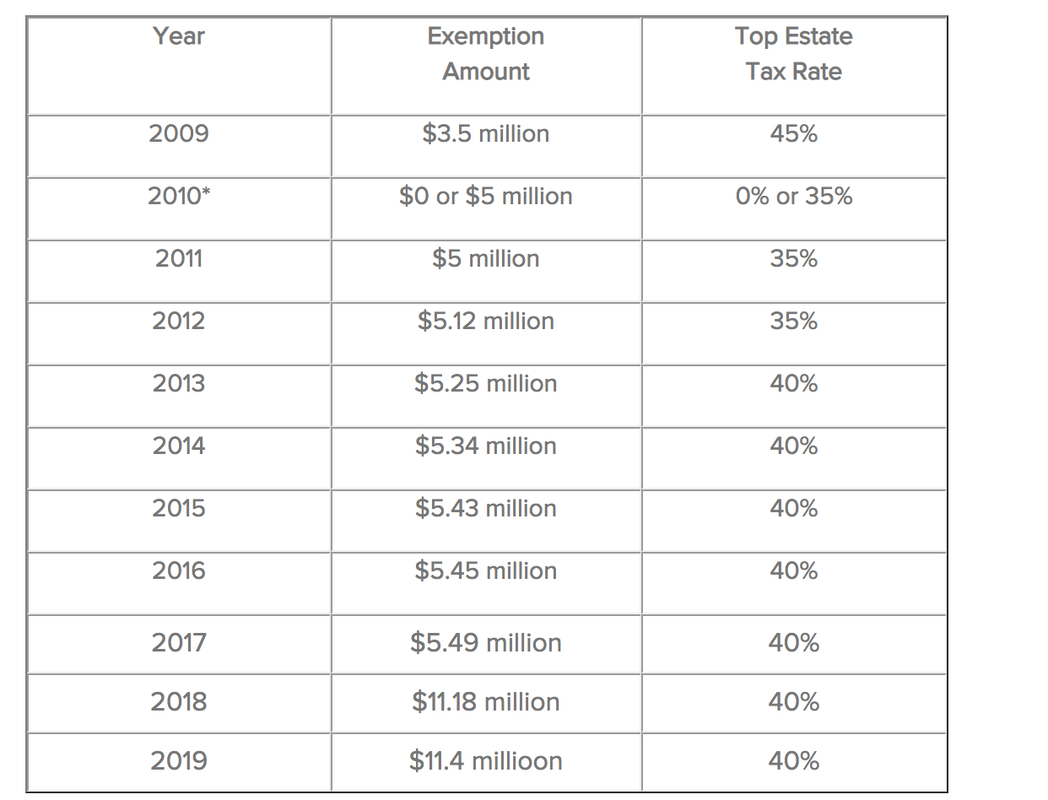

What Is the Federal Estate Tax?The federal estate tax is a tax on property that is transferred to others upon your death. Estate taxes are assessed on the total value of your estate — your home, stocks, bonds, life insurance, and other assets of value — that is over the applicable exemption amount. Everything you own, whatever the form of ownership and regardless of whether the assets have been through probate, is subject to estate taxes. Also referred to as the “death tax,” the federal estate tax was first enacted in this country with the Stamp Act of 1797 to help pay for naval rearmament. After several repeals and reinstatements, the Revenue Act of 1916 put the current estate tax into place. Despite its long history, this tax remains controversial. Estate taxes are calculated on the net value of your estate, which includes all your assets less allowable debts, expenses, and deductions (such as mortgage debt and administrative expenses for the estate). If you have made no taxable gifts, you can estimate the federal estate tax by simply subtracting the applicable estate tax exemption from your taxable estate, and the resulting taxable value is multiplied by 40%, the current federal estate tax rate. The most common exception to the federal estate tax is the unlimited marital deduction. The government exempts all transfers of wealth between a husband and wife from federal estate and gift taxes, regardless of the size of the estate. (The surviving spouse must be a U.S. citizen to qualify for this deduction.) However, when the surviving spouse dies, the estate is subject to estate taxes and, unless the appropriate portability preparations have been made, only the surviving spouse’s applicable exemption can be used. There is also an estate tax deduction for transfers to charity. The Economic Growth and Tax Relief Reconciliation Act of 2001 gradually increased the federal estate tax exemption until finally repealing the federal estate tax altogether for the 2010 tax year only. The 2010 Tax Relief Act reinstated the federal estate tax with a $5 million exemption (indexed annually for inflation after 2011) through December 31, 2012. The 2010 estate tax provisions were made permanent by the American Taxpayer Relief Act of 2012, although the top federal estate tax rate was raised to 40%. The applicable exemption amount in 2017 is $5.49 million. The latest major piece of tax legislation is the Tax Cuts and Jobs Act, which was signed into law on December 22, 2017. This Act doubled the federal estate tax exclusion to $11.18 million in 2018 (indexed annually for inflation) while retaining the 40% tax rate. In 2026, the exclusion is scheduled to revert to its pre-2018 level. Check with your tax advisor to be sure that your estate is protected as much as possible from estate taxes upon your death. * Executors for estates of decedents who died in 2010 had the option of electing to use the 35% rate, $5 million exemption, and "stepped up" basis of inherited assets for income tax purposes or zero estate tax liability with "carry over" basis of inherited assets for income tax purposes. The information in this newsletter is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2019 Broadridge Investor Communication Solutions, Inc.

0 Comments

Leave a Reply. |

Archives

January 2019

Categories

All

|

|

|

Contact Us

|

© 2024 Sunshine Financial Solutions of South Florida, Inc.

Securities offered through OneAmerica Securities, Inc., a Registered Investment Advisor, member FINRA SIPC. Sunshine Financial Solutions of South Florida, Inc. is not an affiliate of OneAmerica Securities or the companies of OneAmerica and is not a broker dealer or Registered Investment Advisor. Provided content is for overview and informational purposes only and is not intended and should not be relied upon as individual tax, legal, fiduciary, or investment advice. Neither OneAmerica Securities, the companies of OneAmerica, or Sunshine Financial Solutions of South Florida, Inc. provide tax or legal advice. For answers to specific questions and before making any decisions, please consult a qualified attorney or tax advisor. Guarantees are subject to the claims paying ability of the issuing insurance company.

Securities offered through OneAmerica Securities, Inc., a Registered Investment Advisor, member FINRA SIPC. Sunshine Financial Solutions of South Florida, Inc. is not an affiliate of OneAmerica Securities or the companies of OneAmerica and is not a broker dealer or Registered Investment Advisor. Provided content is for overview and informational purposes only and is not intended and should not be relied upon as individual tax, legal, fiduciary, or investment advice. Neither OneAmerica Securities, the companies of OneAmerica, or Sunshine Financial Solutions of South Florida, Inc. provide tax or legal advice. For answers to specific questions and before making any decisions, please consult a qualified attorney or tax advisor. Guarantees are subject to the claims paying ability of the issuing insurance company.

RSS Feed

RSS Feed